By Jason Crane

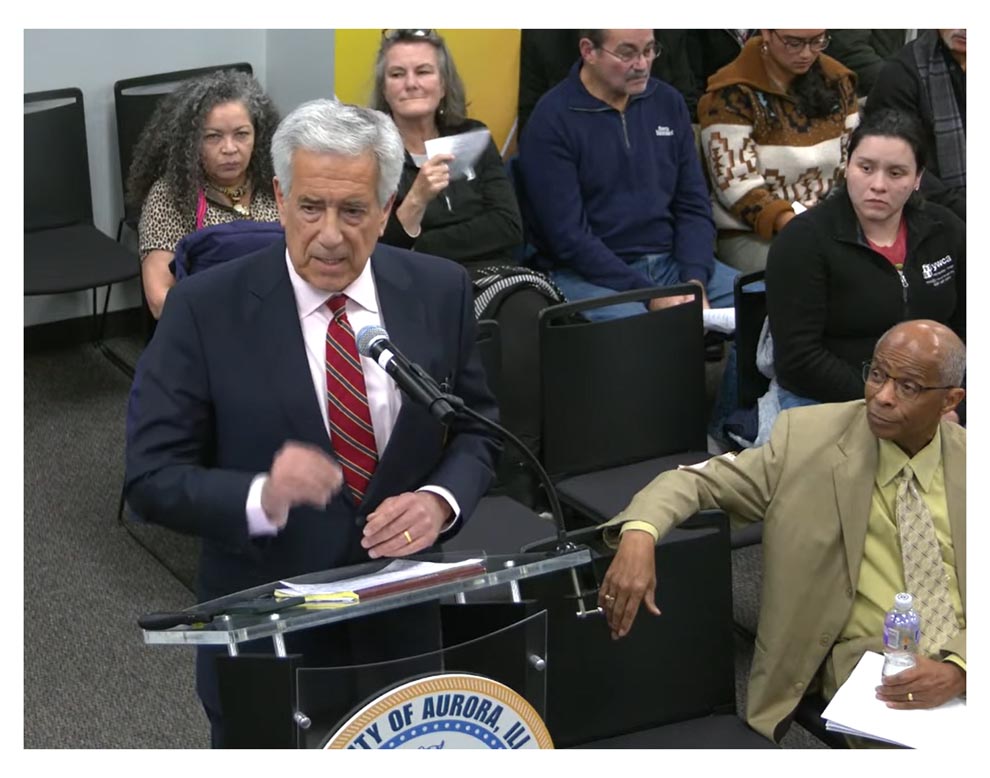

The Aurora City Council listened to more than a dozen speakers at a public hearing for the proposed Farnsworth Bilter TIF (tax increment financing) District, Tuesday, Dec. 12. Individuals spoke both for and against the District.

City government of Aurora documents show as part of the agreement, the City provided a $50 million bond to help build the new Hollywood Casino resort development which recently broke ground. The bond will be serviced by the increase in property tax revenues from the new development at $5.25 million per year. Should the increase in property tax revenues be less than $5.25 million in any year, PENN Entertainment is required to pay the difference so that the City receives the full $5.25 million per year for the life of the bond.

The District boundaries are Church Road on the west, Corporate Boulevard to the south, Farnsworth Avenue to the east, and Bilter Road to the north. Adjacent rights-of-way are included.

Alderman-at-large, John Laesch, recently voiced his opposition to the TIF District stating the $50 Million is a corporate subsidy for a wealthy corporation, in this case, Penn Entertainment that made $2.75 Billion in gross profits the last two years, and whose CEO made $65 million in compensation for the same year.

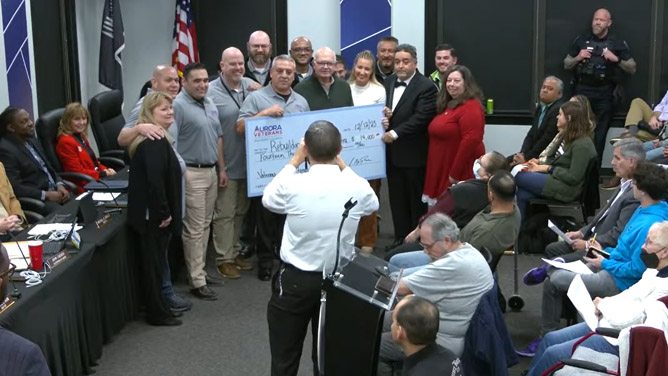

*Aurora’s Veterans Advisory Council presented a donation of $14,000 to Rebuilding Together Aurora, for four homes built for veterans in need. The presentation can be viewed on the city government of Aurora’s YouTube page after the 10 minute mark by clicking here.

*Comments and a presentation about the Farnsworth Bilter TIF can be viewed on the city government of Aurora’s YouTube page after the 13 minute mark by clicking here.

The City Council approved the following agenda items:

- Approved was an Ordinance levying taxes for the city of Aurora, for the Fiscal Year January 1, 2023 through December 31, 2023.

The purpose is to facilitate the City Council’s passage of the proposed 2023 property tax levies for the City government.

City government of Aurora documents show the City obtains the resources for its operations through a variety of sources. The annual property tax levy provides a major share of the revenue – approximately 10% of the revenue for all City funds and about 35% of the revenue for the General Fund.

35 ILCS 200/18-60 requires that each taxing district in Illinois determine an estimate of money to be raised by the taxation of taxable property not later than 20 days prior to adoption of a tax levy. Estimates of the 2023 property tax levies for the City were included in the proposed 2024 City Budget released October 12, 2023.

The proposed City tax levy total is $87,370,400, including City debt service, and represents a 2.6% increase over the City’s levy request of $85,147,100. This is $1,925,092 or 2.25% higher than the 2022 extensions. This change is due to a $2.250 million increase in the Police/Firefighter pension fund levies. The City’s required contribution for public safety pension levies is increasing mainly due to the poor returns prevalent in the investment markets during 2022. The difference between the levy amount and the amount extended is an allowance for uncollectable taxes as added by the counties.

City government officials anticipate the 2023 property tax levy will result in an approximate 2.6% increase in the City portion of the tax bill as a result of the increase in the pension levies. The owner of a $300,000 property would experience an annual increase of approximately $44 for the City portion of the tax bill based on the estimated average EAV increase of 6.5% for the City overall.

While the total amount of the levy is increasing, it is anticipated that the City’s tax rate will decline for the 9th straight year. Although City officials will not have the final amount until the spring of 2024, staff members are estimating the City’s rate will decline by approximately 4%. The decline in the City’s property tax rate is due to the continued increase in the City’s property tax base as measured by equalized assessed valuation (EAV), or taxable value.

Since 2015 the City’s EAV has increased by more than $1.6 billion. During that same time frame, the City’s tax rate has declined by 19% while property tax collections have increased by more than 20%. The increase in EAV allows new money to come into the City’s coffers while simultaneously reducing the tax rate paid by City property owners. Staff members estimate that the City’s EAV will increase by approximately 6.5% for the 2023 levy.

The following dates are key, leading to the passage of the City’s 2023 property tax levies.

11/30/2023: Proposed tax levy ordinances considered by the Finance Committee.

12/5/2023: Proposed tax levy ordinances considered by the Committee of the Whole.

12/12/2023: City Council adopts tax levy ordinances during its regular meeting.

12/26/2023: Last day for filing tax levy ordinances with the county clerks.

Adoption of the 2023 Tax Levy Provides required funding for the City’s General Operating, Police, and Firefighter’s Pension Funds.

- Approved was an Ordinance authorizing and providing for the abatement of general obligation bond tax levies. 2023 tax levy extension.

The purpose is to obtain the City Council’s approval of a proposed ordinance that would serve to abate a portion of the City’s 2023 property tax levies for general obligation (GO) bond debt service.

City government of Aurora documents show at this time, the City has GO bonds outstanding from seven separate issues (not including library issues). The enabling ordinances related to these bonds provide for the automatic levy of property taxes to satisfy annual debt service requirements. These automatic tax levies are in place notwithstanding the regular annual City property tax levies.

For several years, the City has abated all or a portion of its property tax levies for GO debt service because it has had other revenue sources available to cover required debt service.

For the 2023 tax levy year (taxes payable in 2024), the City government is again in a position to abate a large portion of the debt service associated with the City’s GO bond issues. The total amount of this abatement would be $12,312,954.82. This amount is higher than in previous years due to the new process for paying the Library Bond Debt Service and the issuance of a 2023 General Obligation Bond. The debt service for the Series 2012A GO Bonds, issued to finance the main library construction project, will be abated. The debt service for the 2012A GO Bonds will be part of the library district of the levy.

Each year the City will work with the Library to ensure that the Library adopts their tax levy to include the above bond payments. This process was outlined in the Intergovernmental Agreement regarding the Library conversion to an independent district. Once receiving this levy, the City can then safely proceed with abating the “City” tax on these bonds, replacing that levy with the “Library” tax for those bonds. As long as the City and Library have co-terminus boundaries, there is absolutely no impact to an Aurora taxpayer for this change.

Per the 2024 Budget, the sources for abatement are planned to change in 2024. In previous years, the City has used real estate transfer tax revenues to abate City bonds. The actual sources of abatement revenues can be changed by the City during 2023, however the abatement amounts are set and may not be changed after the abatement deadline at each county. The City will provide all four counties with this information in advance of the filing deadlines for levies and abatements to ensure proper calculation.

Adopting this Ordinance provides a reduction in the property taxes levied for debt service purposes per the bond ordinances on file with each respective County.

- Approved was an Ordinance levying certain Special Service Area taxes for the Fiscal Year January 1, 2023 through December 31, 2023. The Special Service Areas are: Number One, Forty-Four, Sixty-Three, Sixty-Five, Sixty-Six A, Sixty-Six B, Sixty-Six C, Sixty-Six D, Sixty-Seven, Eighty-Eight, Ninety, One Hundred Forty-One, Twenty- Four.